The Real Scoop On Real Estate

Real Estate Perspective and Market information for Eugene, Springfield and all of Lane County Oregon by Steve & Sally Jo Wickham

Wednesday, May 29, 2019

Friday, October 14, 2016

Do You Know the Cost of Renting vs. Buying? [INFOGRAPHIC]

Some Highlights:

- Historically, the choice between renting or buying a home has been a close decision.

- Looking at the percentage of income needed to rent a median priced home today (30%) vs. the percentage needed to buy a median priced home (15%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own!

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

Thursday, October 13, 2016

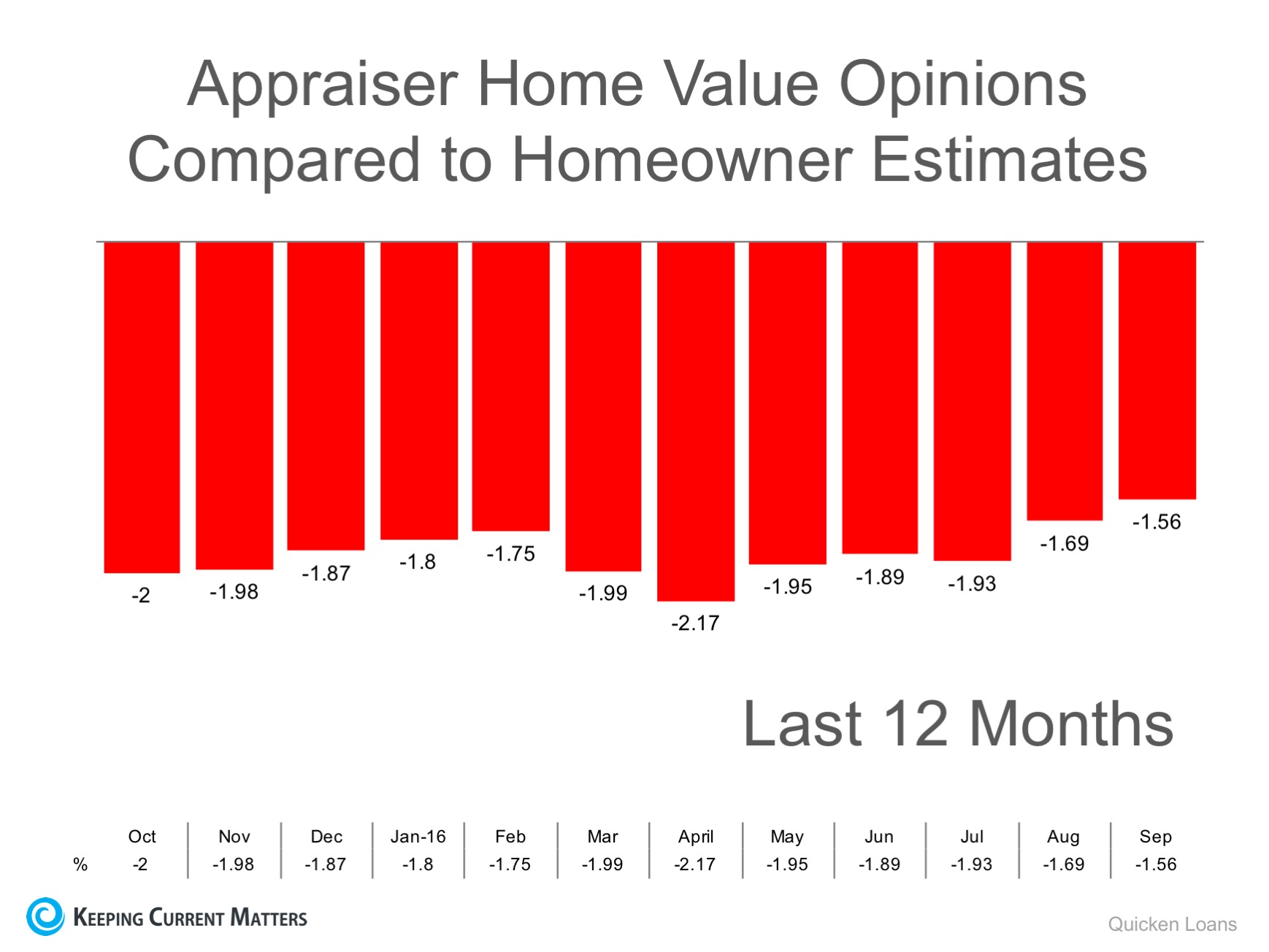

Appraisers & Homeowners Don’t See Eye-To-Eye on Values

In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5%+ over the next twelve months. One major challenge in such a market is the bank appraisal.

If prices are surging, it is difficult for appraisers to find adequate, comparable sales (similar houses in the neighborhood that closed recently) to defend the selling price when performing the appraisal for the bank.

Every month, Quicken Loans measures the disparity between what a homeowner believes their house is worth as compared to an appraiser’s evaluation in their Home Price Perception Index (HPPI). Here is a chart showing that difference for each of the last 12 months.

Bottom Line

Every house on the market has to be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). With escalating prices, the second sale might be even more difficult than the first. If you are planning on entering the housing market this year, meet with an experienced professional who can guide you through this, and any other obstacle that may arise.

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

Wednesday, October 12, 2016

The Role Access Plays in Getting Your House SOLD!

So you’ve decided to sell your house. You’ve hired a real estate professional to help you with the entire process and they have asked you what level of access you want to provide to potential buyers.

There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing and Price. There are many levels of access that you could provide to your agent to be able to show your home.

Here are five levels of access that you could give a buyer with a brief description:

- Lockbox On the Door – this allows buyers the ability to see the home as soon as they are aware of the listing, or at their convenience.

- Providing a Key to the Home – although the buyer’s agent may need to stop by an office to pick up the key, there is little delay in being able to show the home.

- Open Access with a Phone Call – the seller allows showing with just a phone call’s notice.

- By Appointment Only (example: 48 Hour Notice) – Many out-of-town/state buyers and relocation buyers visit an area they would like to move to and only have the weekend to view homes. They may not be able to plan that far in advance, or may be unable to wait the 48 hours to be shown the house.

- Limited Access (example: the home is only available on Mondays or Tuesdays at 2pm or for only a couple of hours a day) - This is the most difficult way to be able to show your house to potential buyers.

In a competitive marketplace, access can make or break your ability to get the price you are looking for, or even sell your house at all.

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

Tuesday, October 11, 2016

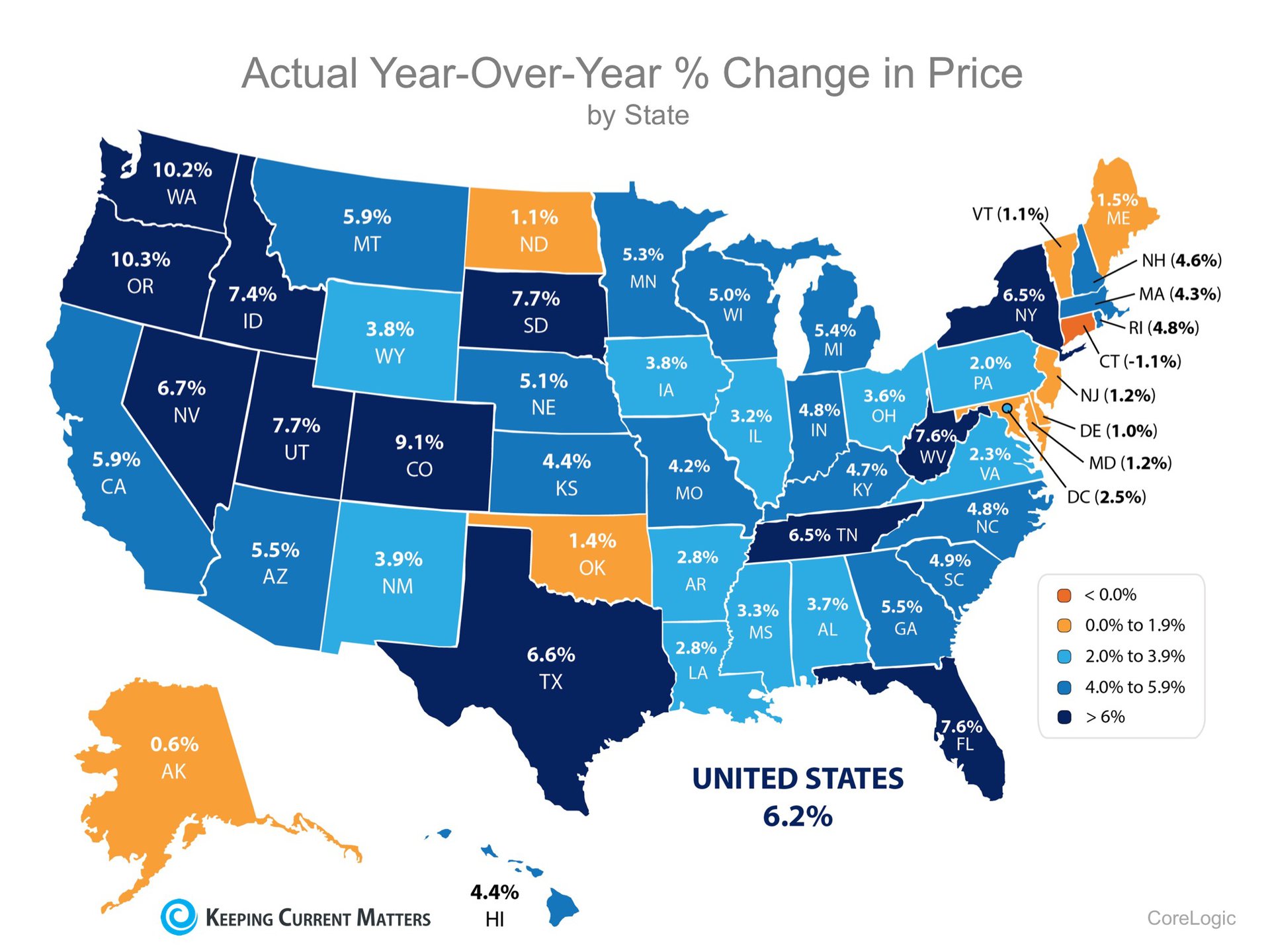

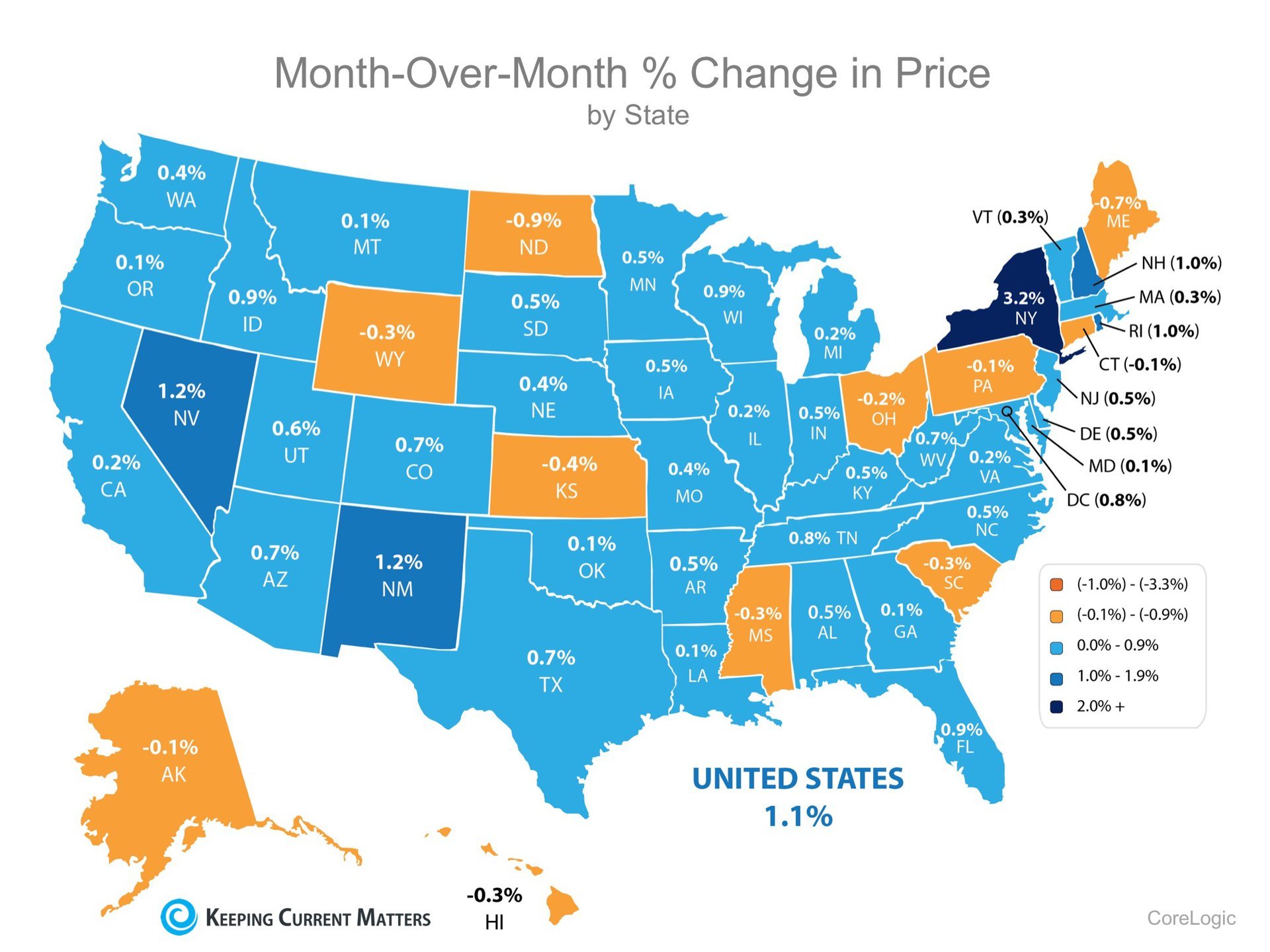

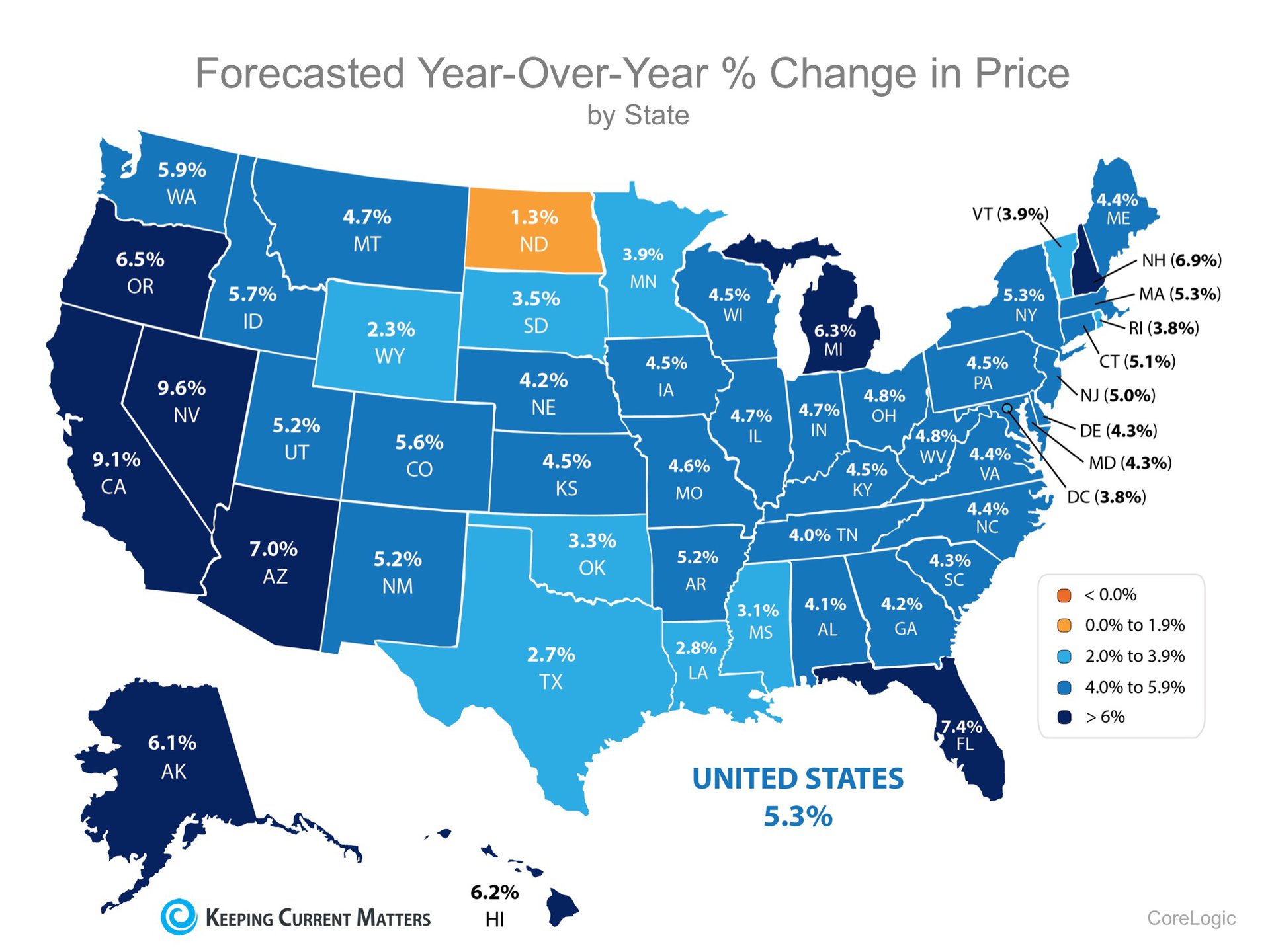

The Past, Present & Future of Home Prices

CoreLogic released their most current Home Price Index last week. In the report, they revealed home appreciation in three categories: percentage appreciation over the last year, over the last month and projected over the next twelve months.

Here are state maps for each category:

The Past – home appreciation over the last 12 months

The Present – home appreciation over the last month

The Future – home appreciation projected over the next 12 months

Bottom Line

Homes across the country are appreciating at different rates. If you plan on relocating to another state and are waiting for your home to appreciate more, you need to know that the home you will buy in another state may be appreciating even faster.

Meet with a local real estate professional who can help you determine your next steps.

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

Monday, October 10, 2016

3 Questions to Ask Before Buying Your Dream Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following 3 questions to help determine if now is actually a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This truly is the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a recent survey by Braun showed that over 75% of parents say “their child’s education is an important part of the search for a new home.”

This survey supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the four major reasons people buy a home have nothing to do with money. They are:

- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Home Price Index from CoreLogic, home values are projected to increase by 5.3% over the next 12 months.

What does that mean to you?

Simply put, if you are planning on buying a home that costs $250,000 today, that same home will cost you an additional $13,250 if you wait until next year. Your down payment will need to be higher as well to account for the higher home price.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

The Mortgage Bankers Association (MBA), the National Association of Realtors, Fannie Mae and Freddie Mac have all projected that mortgage interest rates will increase over the next twelve months as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

For more information on the housing market and personalized help buying/selling your home, visit teamwickham.com!

Sunday, October 9, 2016

Subscribe to:

Comments (Atom)

![Do You Know the Cost of Renting vs. Buying? [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2016/10/20161014-Rent-vs.-Buy-KCM.jpg)