Summer is here! The temperature isn't the only thing heating up right now, so too is the housing market! Here are four great reasons to consider buying a home today instead of waiting.

1. Prices Will Continue to Rise

The Home Price Expectation Survey polls a distinguished panel of over 100 economists, investment strategists, and housing market analysts. Their most recent report projects appreciation in home values over the next five years to be between 11.8% (most pessimistic) and 26.7% (most optimistic).The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

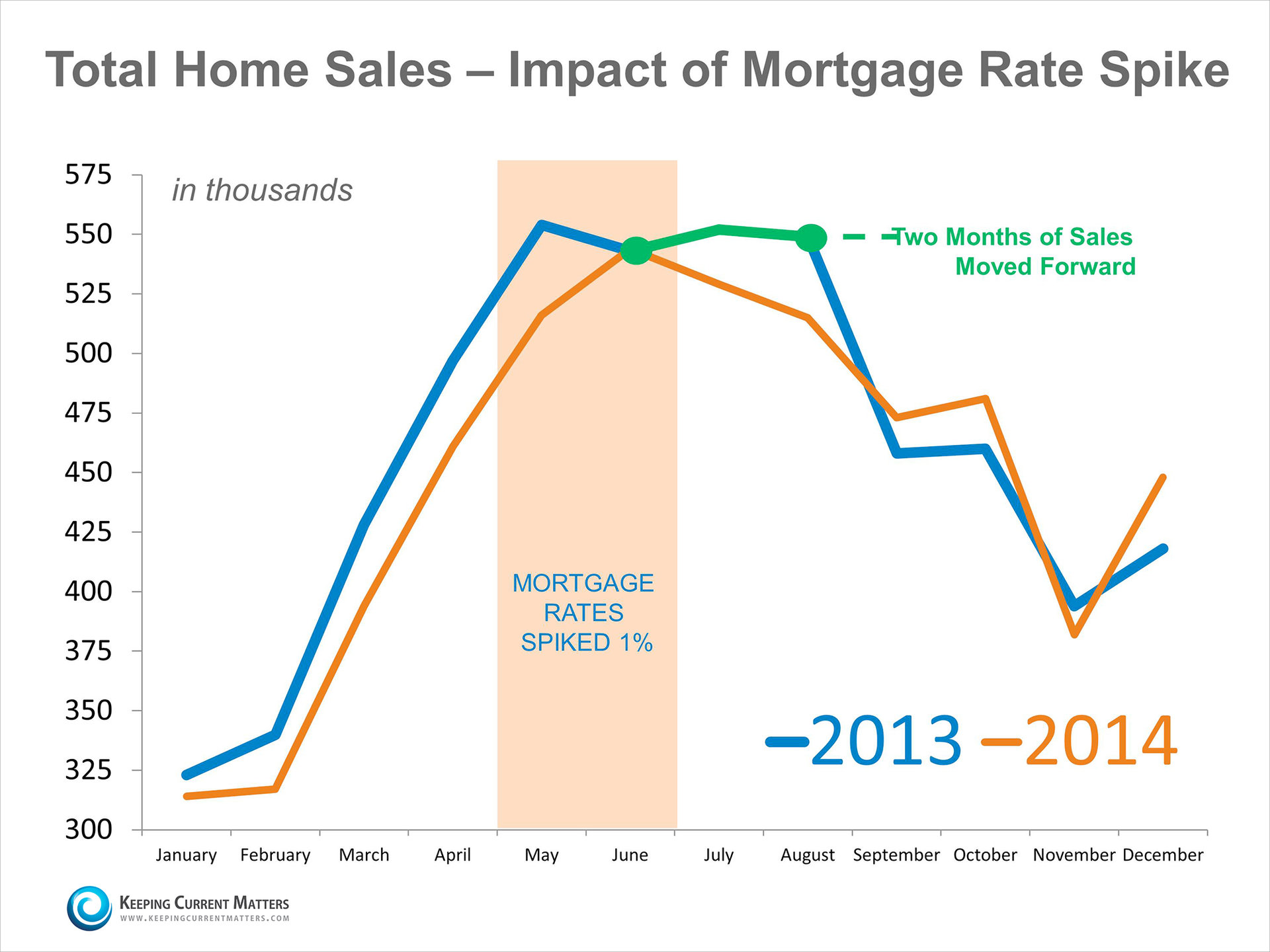

2. Mortgage Interest Rates Are Projected to Increase

Freddie Mac’s Primary Mortgage Market Survey shows that interest rates for a 30-year mortgage have started to inch up, most experts predict that they will begin to rise even more over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac & the National Association of Realtors are in unison projecting that rates will be up approximately three quarters of a percentage point over the next 12 months.An increase in rates will impact YOUR monthly mortgage payment. Your housing expense will be more a year from now if a mortgage is necessary to purchase your next home.

3. Either Way You are Paying a Mortgage

As a recent paper from the Joint Center for Housing Studies at Harvard University explains:“Households must consume housing whether they own or rent. Not even accounting for more favorable tax treatment of owning, homeowners pay debt service to pay down their own principal while households that rent pay down the principal of a landlord plus a rate of return. That’s yet another reason owning often does—as Americans intuit—end up making more financial sense than renting.”

4. It’s Time to Move On with Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears that both are on the rise.But, what if they weren’t? Would you wait?

Look at the actual reason you are buying and decide whether it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer or you just want to have control over renovations, maybe it is time to buy.